haylend.com

Deposit Terms and Conditions

|

Type |

Time deposit |

|

Currency |

USD, AMD |

|

Minimum amount |

USD 2,000; AMD 1,000,000 |

|

Maximum amount |

USD 20,000; AMD 10,000,000 |

|

Effective period |

366 - 1470 days |

|

Interest payment |

At expiry |

|

Interest capitalization |

N/A |

|

Deposit replenishment |

N/A |

|

Partial deposit withdrawal |

N/A |

Annual simple interest rate

|

Deposit currency |

Effective period |

|||

|

366 - 546 days |

547 - 730 days |

731 - 1095 days |

1096 - 1470 days |

|

|

USD |

4.00% |

4.25% |

5.25% |

5.75% |

|

AMD |

8.50% |

8.75% |

9.75% |

10.00% |

Annual interest income

|

Deposit currency |

Effective period |

|||

|

|

366 - 546 days |

547 - 730 days |

731 - 1095 days |

1096 - 1470 days |

|

USD |

3.92% - 3.98% |

4.15% - 4.17% |

4.99% - 5.10% |

5.30% - 5.44% |

|

AMD |

8.25% - 8.45% |

8.37% - 8.49% |

8.91% - 9.29% |

8.76% - 9.12% |

NOTE

Income tax at 10% is charged on the accrued interest.

Calculation of annual percentage yield

The interests accrued on your deposit are calculated based on the simple interest formula, and the annual percentage yield shows how much you would earn if you re-deposited the interest accrued against the deposit.

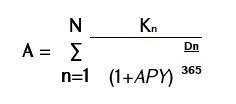

The annual percentage yield of the deposit is calculated based on the Formula set under the CBA Regulation 8/02 “On Calculation of Annual Percentage Yield of Bank Deposits.”

where

- A - the initial deposit amount

- ո - the subsequent number of the deposit related cash flows

- N - the last number of the deposit related cash flows (including the cash flow at the point of opening the deposit), after which the deposit agreement is deemed expired

- Kո - mandatory payment flows at the point of opening the deposit and/or the sum deposited in the effective period of the deposit and/or capitalized interest, if any

- Dո - is the number that indicates how many days have passed since the date of opening of the deposit until the subsequent nth deposit related cash flow (at the point of opening of the deposit D1 = 0)

Calculation examples for deposit on below terms

|

Initial amount |

AMD 5,000,000 |

|

Opening date |

01/05/2020 |

|

Effective period |

366 days (until 02/05/2021) |

|

Annual interest rate |

8.5% |

|

Interest payment |

At expiry |

|

Income tax |

10% from interest income |

Example of interest amount calculation

Interest income per day

For year 2020:

5,000,000 (deposited amount) x 8.5/100 (annual interest rate) / 366 (number of days in a year) = AMD 1,161.20

For year 2021:

5,000,000 (deposited amount) x 8.5/100 (annual interest rate) / 365 (number of days in a year) = AMD 1,164.40

Total interest income for 366 days

1,161.20 x 245 + 1,164.40 x 121 = AMD 425,386.40

Net interest income for 12 months

425,386.40 – 42,538.60 (10% of total interest income: taxable income amount) = AMD 382,847.80 (amount payable

to depositor at expiry)

The numbers are rounded to the nearest tenth.

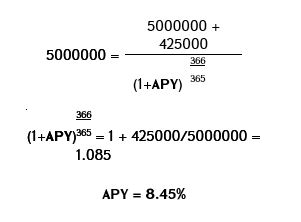

Example of annual percentage yield calculation

Applying the Formula to the parameters of the deposit:

General terms and conditions for opening of deposit

- The deposit will be opened based on the deposit application (hereinafter the Application) created on haylend.com (hereinafter the Platform).

- The correspondence is carried on between the Depositor and Converse Bank CJSC (hereinafter the Bank) on the Platform and/or on the email specified by the Depositor in the Application submitted to the Bank on the Platform.

- Prior to conclusion of the deposit agreement, the Bank makes a video call to the Depositor by the media specified by the latter in the Application, to directly obtain the Depositor’s consent on the terms and conditions of the deposit.

- The deposit is opened noncash by transferring a sum from the Depositor, which is recorded on the latter’s account opened with the Bank.

- The opening of the deposit is certified with an agreement.

- The deposit cannot be replenished throughout the effective period of the deposit.

|

ATTENTION |

|

The deposit is opened once the amount is recorded on the Depositor’s account opened with Bank. This is done by making a transfer on behalf of the Depositor from a financial organization acceptable for the Bank. For AMD deposit, the change in the USD exchange rates can have an impact on the paid amounts of deposit and interest. |

|

For AMD deposit, the USD amount transferred by the Depositor to the account opened with the Bank, is converted into AMD at the noncash buy rate applied by the Bank at the date of opening of the deposit. The amount of the deposit can differ from the initial amount specified by the Depositor in the Application if: a)The amount transferred by the Depositor to the account opened with the Bank is deducted by the amount of additional charges by intermediary banks, and with this respect no claims may be presented to the Bank by the Depositor b) The deposit is opened in AMD (since the conversion from USD into AMD is implemented by the rate specified by the Bank as of the time of conversion). The total amount transferred on behalf of the Depositor and recorded on the account opened for the latter shall be attracted by the Bank as a deposit; furthermore, where at the point of opening of the deposit the funds available on the account opened with the Bank exceed the maximum amount set by the Bank for the particular type of deposit, then the amount is deposited to the maximum amount defined for the particular type of deposit, and the difference is deemed attracted on the terms of demand deposit effective at the Bank. The demand sum is transferred to the customer once the time deposit is redeemed, together with the deposit amount and interest. At the Depositor’s discretion, the difference can be transferred to the Depositor’s account. On the day of redemption of the AMD deposit, the deposit amount and interest are paid with AMD on the Depositor’s account opened with the Bank, thereafter converted into USD at the noncash sell rate applied by the Bank at the date of opening of the deposit, to have the total amount transferred to the Depositor’s account opened with another financial organization. |

|

Unless the Depositor notifies the Bank about the change in the their bank details and unless discloses the new bank details acceptable for the Bank, the Bank transfers the deposit amount, interest and the demand amount, if any, by using the details of the financial organization where from the deposit amount was originally received. Unless the Depositor discloses the details of a financial organization acceptable for the Bank, the Bank can demand the Depositor’s visit to the Bank to receive the deposit amount and interest in person. |

|

The Bank transfers the deposit amount and interest to the financial organization only to the account opened on behalf of the Depositor. |

|

The Bank shall decline the Application in below cases: 1. a) The Depositor fails to disclose to the Bank all details of the transactions for opening of the deposit required under the AML/CFT related international norms or RA laws and/or internal regulations of the Bank; b) The Customer’s business or the business relation with the latter can, in the Bank’s judgment, arouse suspicion with any partner or international organization about the Application of inefficient AML/CFT remedies by the Bank, and/or can have an adverse effect on the Bank’s reputation (for instance, if the Customer or parties related thereto appear in any of the blacklists of the UN Security Council, USA or European Union or any other special sanction lists); c) The Customer’s business or any transaction made thereby is from the AML/CFT perspective viewed as matching with the standards of being suspicious, and the supporting documents and/or justifications have not been disclosed in the set deadlines. |

|

2. The Bank does not identify the customer with the details disclosed to the Bank, and/or during the video call the Bank does not receive from the customer satisfactory assurances, based whereon the Bank could conclude that the customer was personally willing to open a deposit with the Bank on terms stated in the Application. |

|

3. The deposit amount is to be or has been transferred by a financial organization unacceptable for the Bank, and/or a third party other than the depositor has been involved in the transfer process. |

|

4. The amount available on the customer’s account with the Bank is smaller than the minimum amount set for the particular type of deposit at the point of opening. In such case, the deposit amount is returned to the customer. |

|

5. The customer has failed to make the transfer or the transferred amount has not been recorded on the customer’s account with the Bank in 10 (ten) banking days from disclosure of the customer’s bank details. |

|

6. The Bank transfers the deposit amount to the Depositor’s account opened with another financial organization on terms and at rates applied to OUR2 option at the date of transfer. |

2 The amount shall reach the beneficiary’s account entirely when transferred to bank located in USA, otherwise the

transferred amound shall be deducted by charges of intermediary bank/s/.

Interest calculation and payment

- Interests are calculated against the actual balance on the deposit account, starting from the day following the entry of the deposit amount into the Bank through the day preceding the day when the deposit is returned to the Depositor or is withdrawn from the Depositor’s account on whatever ground.

- The Bank calculates the interests at a simple interest rate, by taking 365-day year (366-day leap year) as a divisor.

- The interest is calculated daily against the balance on the account.

- The Bank cannot unilaterally decrease the interest rate determined under the deposit agreement.

Additional information

- Opening and servicing of time deposit is free of charge.

- The deposit account is closed at the expiry of the deposit agreement.

- The Depositor cannot make current banking transactions on the deposit account other than opening and redemption of the deposit.

- The information about the bank deposit is deemed banking secrecy and the Bank guarantees the confidentiality.

Early termination of deposit agreement

Where on the Depositor’s demand the time deposit is returned before expiry, the interests are recalculated at the rate applied by the Bank to the demand deposit at that point (0.1% per annum).

Settlement of disputes

Any dispute or discrepancy between the Customer and the Bank, unless settled through negotiations, are regulated in compliance with the RA laws, both judicially and by the Financial System Mediator.

Tariffs for transfer transactions

|

USD transfers by the Bank (OUR) * |

0.1%, min AMD 7,000, max AMD 45,000 ** |

|

Transfer search, change of terms, fulfillment of callback instruction, return of transfer by correspondent bank |

AMD 25,000 *** |

|

SWIFT confirmation for effected transfer |

AMD 3,000 (VAT included) |

* The Bank makes the transfer no later than on the business day following the deposit redemption day.

** The USD funds are charged at the buy rate applied by the Bank at the point of transfer.

*** The tariff includes the correspondent bank’s commissions. The third-bank costs, if any, are additionally charged from the customer.

The paid commission shall not be refunded in the event of unsatisfactory outcome of instruction for reasons independent of the Bank.

Tariffs for issuance of statements

|

Issuance of account statements at the Bank (VAT included) |

|

For 1 statement in periods set under the RA laws – AMD 0 For additional statement out of periods set under the RA laws, for up to 3-year time limitation – AMD 1,000 For 3-year and longer time limitation (if held by the Bank) – AMD 3,000 |

|

Statements to be filed with various institutions (VAT included) |

|

|

For deposits opened less than 1 month |

AMD 5,000 |

|

For deposits opened more than 1 month |

AMD 3,000 |

|

Copies of documents, transaction grounds and other information (VAT included) |

|

|

For up to 1-month time limitation |

AMD 1,800 per document |

|

For up to 1-year time limitation |

AMD 3,000 per document |

|

For up to 3-year time limitation |

AMD 12,000 per document |

|

For 3-year and longer time limitation (if held by the Bank) |

AMD 24,000 per document |

NOTICE ON DEPOSIT GUARANTEE TERMS AND PROCEDURE

The Deposit Guarantee Fund is the guarantor of your deposit.

|

Deposit currency structure |

Max amount of guaranteed deposit |

|

|

If you have only AMD deposit with the same bank |

AMD 10M |

|

|

If you have only USD deposit with the same bank |

AMD 5M |

|

|

If you have AMD and USD deposits with the same bank |

If AMD deposit is above AMD 5 M |

AMD 10M (only AMD deposit is guaranteed) |

|

If AMD deposit is below AMD 5 M |

AMD 5 M (AMD deposit is guaranteed totally and USD deposit – to the amount of difference between AMD 5 M and refundable AMD deposit) |

|

Address: M. Khorenatsi, 0010 Yerevan (Elite Plaza business center)

Tel. +374 10 583514

NOTICE ON FINANCIAL SYSTEM MEDIATOR

Herewith please be advised that under the RA Law on Financial System Mediator, upon a property claim at up to AMD 10M or the equivalent amount in foreign currency, the disputes and discrepancies arising with regard to the services rendered to you by Converse Bank CJSC, can be settled by the Financial System Mediator.

Under the agreement effected between the Bank and the Financial System Mediator, the Bank waivers its right of appeal against the decisions of the Financial System Mediator only for claims not surpassing the amount of AMD 250,000 (two hundred and fifty thousand) or the equivalent amount in foreign currency, and where the total amount of the transaction does not surpass AMD 500,000 (five hundred thousand) or the equivalent amount in foreign currency.

Address: 15 M. Khorenatsi, 0010 Yerevan (7th floor, Elite Plaza business center)

Email [email protected]; Tel +374 60 701111; fax +374 10 582421

Contact the Bank

For additional information, please:

- Visit the Bank’s website conversebank.am

- Visit the Head Office Customer Service Unit or any branch of the Bank

- Call +374 10 511211 (Viber +374 95 511 211; Skype conversebank-callcenter)