Time Deposit Progress

Terms and Condition of Deposit

|

Deposit currency |

AMD, USD, EUR |

|

Deposit type |

Time deposit without the option of replenishment and with partial withdrawal |

|

Minimum amount of deposit |

AMD 30,000 / USD 500 /EUR 500 |

|

Maximum amount of deposit |

AMD 50,000,000 / USD 100,000 / EUR 50,000 |

|

Deposit maturity |

45 days / 3 months / 6 months / 9 months / 12 months / 18 months / 24 months |

|

Payment of interest |

Upon the maturity or monthly as preferred by the depositor |

|

Interest capitalization |

The calculated interests are not accrued on deposit balance. |

|

Maximum amount of deposit partial withdrawals |

After withdrawals the deposit balance may not be less than the minimum set for the deposit type. |

|

* Where the deposited amount exceeds AMD 50,000,000, USD 100,000 and EUR 50,000 contractual interest rate is set. |

|

Annual simple interest rate and percentage yield

|

Simple annual interest rate given the interests to be paid upon maturity

|

|||||||

|

Deposit currency |

Deposit maturity |

||||||

|

45 days |

3 months |

6 months |

9 months |

12 months |

18 months |

24 months |

|

|

AMD |

5.50% |

6.50% |

7.75% |

8.75% |

9.50% |

9.75% |

10.00% |

|

USD |

0.75% |

1.50% |

2.40% |

3.10% |

3.75% |

3.90% |

4.00% |

|

EUR |

0.50% |

0.75% |

1.20% |

1.50% |

2.0% |

2.15% |

2.25% |

|

Annual percentage yield given the interests to be paid upon maturity |

|||||||

|

Deposit currency |

Deposit maturity |

||||||

|

45 days |

3 months |

6 months |

9 months |

12 months |

18 months |

24 months |

|

|

AMD |

5.63% |

6.66% |

7.90% |

8.84% |

9.50% |

9.53% |

9.54% |

|

USD |

0.75% |

1.51% |

2.41% |

3.11% |

3.75% |

3.86% |

3.92% |

|

EUR |

0.50% |

0.75% |

1.20% |

1.50% |

2.00% |

2.14% |

2.23% |

|

Simple annual interest rate given the interests to be paid monthly |

||||||

|

Deposit currency |

Deposit maturity |

|||||

|

3 months |

6 months |

9 months |

12 months |

18 months |

24 months |

|

|

AMD |

6.00% |

7.25% |

8.25% |

9.00% |

9.25% |

9.50% |

|

USD |

1.35% |

2.25% |

2.95% |

3.60% |

3.75% |

3.85% |

|

EUR |

0.65% |

1.10% |

1.40% |

1.90% |

2.05% |

2.15% |

Annual percentage yield given the interests to be paid monthly |

||||||

|

Deposit currency |

Deposit maturity |

|||||

|

3 months |

6 months |

9 months |

12 months |

18 months |

24 months |

|

|

AMD |

6.17% |

7.50% |

8.57% |

9.38% |

9.65% |

9.92% |

|

USD |

1.36% |

2.27% |

2.99% |

3.66% |

3.82% |

3.92% |

|

EUR |

0.65% |

1.11% |

1.41% |

1.92% |

2.07% |

2.17% |

|

Savings account opening tariffs for depositors if deposit is opened at branch |

||

|

1 account in deposit currency |

opening |

AMD 0 |

|

Annual service |

AMD 0 |

|

|

Other terms: based on account opening and servicing rules of the Bank |

||

During the deposit operation, the depositor may make partial withdrawals of the deposit amount. In that case, the interest accrued as of the date of withdrawal is recalculated under the following conditions:

|

Attention |

|

Income tax is taxable from interest payments |

|

For cash redemption of deposit opened non-cash, commission is charged at |

|

Period from the date of deposit opening (extension) to the withdrawal of the amount

|

The recalculation is carried out at the minimum of the interest rates valid /effective/ at the time of withdrawal and published on the Bank's website for the periods specified in the table. |

|

Up to 45 days inclusive |

Interest rate set for demand deposit in the bank is 0.1%

|

|

From 45 days to 3 months inclusive |

Interest rate of 45-day Progress deposit in the corresponding currency

|

|

From 3 to 6 months inclusive |

Interest rate of 3-month Progress deposit in the corresponding currency |

|

From 6 to 9 months inclusive |

Interest rate of 6-month Progress deposit in the corresponding currency |

|

From 9 to 12 months inclusive |

Interest rate of 9-month Progress deposit in the corresponding currency |

|

From 12 to 18 months inclusive |

Interest rate of 12-month Progress deposit in the corresponding currency |

|

More than 18 months |

Interest rate of 18-month Progress deposit in the corresponding currency |

|

Attention |

|

|

Interest payable is subject to income tax at the rate of 10% |

|

|

For cash redemption of deposit opened non-cash, commission is charged at 0.25% for AMD / 3% for USD and EUR* |

|

|

* The Bank may set a more favorable commission fee for customers. |

|

Calculation example:

In case of the following conditions:

|

Initial deposit amount |

1,000,000 AMD |

|

Date of making the deposit |

1/12/2023 |

|

Deposit term |

12 months (until 1/12/2024) |

|

Annual interest rate |

9․5% |

|

Interest payment |

At expiry |

|

Income tax |

10% on interest income |

The deposit interest amount is calculated in the following way:

Daily interest income

1,000,000.00 (deposited sum) x 9.5/100 (annual interest rate) / 365 (number of days in a year) = 260.27

Daily interest income during a leap year

1,000,000.00 (deposited sum) x 9.5/100 (annual interest rate) / 366 (number of days in a year) = 259.56

Total interest income for 12 months

260.27 x 31 days + 259.56 x 335 days = 95,022.05

Net interest income for 12 months

95,022.05 - 9,502.20 (10% from total interest income is subject to income tax) = 85,519.84 (interest to be paid to the depositor upon maturity of the deposit)

Total deposit amount (initial deposit + after-tax interests) = AMD 1,085,519.84

Calculated amounts are rounded up to one hundredth.

On below terms:

|

Initial deposit |

AMD 1,000,000 |

|

Opening day |

01/12/2023 |

|

Maturity |

12 months (until 01/12/2024) |

|

Annual interest rate |

9.5% |

|

Payment of interests |

At expiry |

|

Income tax |

10% from interest income |

The deposit interest amount is calculated in the following way:

Daily interest income

1,000,000.00 (deposited sum) x 9.5/100 (annual interest rate) / 365 (number of days in a year) = 260.27

Daily interest income during a leap year

1,000,000.00 (deposited sum) x 9.5/100 (annual interest rate) / 366 (number of days in a year) = 259.56

Total interest income for 12 months

260.27 x 31 days + 259.56 x 335 days = 95,022.05

Net interest income for 12 months

95,022.05 - 9,502.20 (10% from total interest income is subject to income tax) = 85,519.84 (interest to be paid to the depositor upon maturity of the deposit)

Total deposit amount (initial deposit + after-tax interests) = AMD 1,085,519.84

Calculated amounts are rounded up to one hundredth.

Annual percentage yield

The interest on the funds in your account is calculated on the basis of simple interest rate, and the annual interest yield shows the income you would receive as a result of making mandatory payments related to deposit and receiving interest earned on a regular basis.

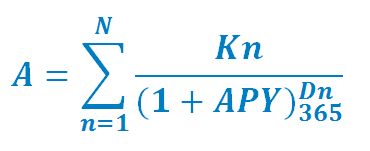

The calculation of the annual percentage yield on the deposit is made on the basis of the following formula set under the Central Bank of the Republic of Armenia Regulation 8/02 "Calculation of the annual percentage yield of bank deposits":

where:

- A - initial deposit amount

- n - the number of cash flows for the deposit

- N - the last number of cash flow for the deposit (including the cash flow at the time of making the deposit), after which the term of the deposit agreement is considered expired.

- Kn - cash flows on deposit made upon making the deposit and/or during the deposit term and/or capitalized interest, and mandatory payments, if any.

- Dn - the number that indicates the quantity of days elapsed since the day of making the deposit up to the next - n-th cash flow for the deposit, inclusively (at the time of making the deposit: D1 = 0)

General terms of accepting deposit

- The deposit is validated on the basis of an agreement.

- According to the agreement, more than one person can be a depositor, in which case the agreement is signed by all parties and the deposit is managed and used with the right of joint ownership.

- If more than one person is a depositor, the amount of the deposit or a part of it as well as the interest accrued on it can be paid either on the condition of mandatory presence of all parties; or it can be paid to only one of the persons involved, on the basis of a notarized power of attorney signed by the other parties.

- Replenishment of the deposit amount during the deposit term is not allowed.

- The depositor has the right to make the deposit to the Bank in the name of a third party in accordance with the RA legislation and in accordance with the procedure established by the Bank's internal legal acts.

- The deposit can also be made online (without the possibility of making a deposit in favor of a third party) with the help of the Online Banking system https://conversebank.am/en/internet-banking/ .

Calculation and Payment of Interests

- The interests are calculated against the actual balance of the deposit from the day of opening of the deposit until the day preceding the day of its return to the depositor or withdrawal from the depositor’s account on other grounds.

- The Bank calculates the interests at a simple interest rate, taking 365 days in a year or 366 days in a leap year as a divisor.

- The interest amount is calculated on a daily basis against the account balance.

- Where the time deposit is opened with a foreign currency, the interests are paid to the depositor with AMD at the respective buy rate set by the Bank at the date of payment for the respective currency or, at the depositor’s discretion, with the currency of the deposit.

- The interests calculated against the deposit, unless the depositor has received in the period set in the deposit agreement, are paid by the Bank to the depositor on the latter’s demand.

- Unless the depositor demand the redemption of the deposit and the payment of the calculated interest after expiry, the agreement is deemed renewed on the terms and conditions of time deposits applied by the Bank at that point, unless otherwise required in the customer’s deposit agreement or based on the customer’s written instruction.

Additional information:

- Time deposit accounts are opened and serviced free of charge.

- The deposit account is closed once the deposit agreement expires.

- No current banking transactions can be executed on the deposit account other than opening and redemption of the deposit.

- The deposit is opened at branches from the savings account with the currency of the deposit; in the absence thereof, the deposit is opened free of opening and service charge.

- The interests accrued on the deposit and the funds credited to the deposit account are paid to the depositor free of any commission.

- The information about the deposit opened with the Bank is deemed bank secrecy and the Bank guarantees its confidentiality.

Early Termination of Deposit Agreement

- If the time deposit is returned on the depositor’s demand before expiry, based on the depositor’s application, the interests are recalculated and the recalculation is made at the demand deposit rate applied by the Bank (currently 0.1%).

- When the depositor dissolves the FX time deposit agreement on the condition of directly concluding a time deposit agreement with AMD on similar terms, the interests are not recalculated.

Communication with the Bank

You can communicate with Converse Bank CJSC either by mail or by email, whichever you prefer. Electronic correspondence is the most convenient, it is 24/7 accessible, is free of any risk of loss of paper-based information and ensures confidentiality.

In addition, during the term of the contract, through electronic communication or by your choice, in another way (for example, postal communication, in the Bank's territory - in person, etc.), the Bank will provide you with the changes and amendments in legal acts and other circumstances having direct impact on the general terms of service and other fees, the order of communication, rights arising from the contract, obligations or responsibilities.

Tariffs for the provision of Extracts and References

|

Handover of statements1 at the Bank (VAT included) |

|

|

Individuals |

- for up to 3-year period: AMD 1,000 - for 3-year and longer period: AMD 3,000 (if stored by the Bank) |

|

Legal entities |

Once (regardless the periodicity)՝ AMD 0 |

|

References to be presented to different institutions1 (including VAT) |

|

|

In case of deposits opened within one month2 |

5,000 AMD |

|

In case of deposits opened earlier |

3,000 AMD |

|

Based on the application submitted through the bank's website |

3,000 AMD |

1For the simultaneous issuance of a reference and a statement to the same customer, the charge is applied only to the reference if such charge is set.

2 In the presence of several accounts, the date of opening of the earliest account is considered, irrespective of being included in the reference.

|

Copies of documents, transaction substantations and other information (including VAT) |

|

|

Dating back up to 1 month |

1,800 AMD for each document |

|

Dating back up to 1 year |

3,000 AMD for each document |

|

Dating back to more than 1 year |

12,000 AMD for each document |

|

Delivery of the Extract by postal service (including VAT) |

|

|

In the Republic of Armenia and Artsakh |

For individuals - 0 AMD For legal entities - 500 AMD |

|

International |

Delivery service provider’s rate in cases stipulated by the Law and the agreement

In other cases, delivery service provider’s rate + AMD 1,500 |

|

Delivery of the Extract through the delegated delivery service (including VAT) |

|

|

In the Republic of Armenia and Artsakh |

3,000 AMD |

|

International |

Tariff set by the delivery service provider |

|

Attention |

|

The Bank may not unilaterally reduce the amount of interest determined by the agreement on deposit which the individual has invested on the condition of redeeming it after the expiration of a certain period or upon occurrence of circumstances stipulated in the agreement. |

|

The Bank has the right to unilaterally change the amount of interest determined by the agreement on deposit which the legal entity has invested on the condition of redeeming it after the expiration of a certain period or upon occurrence of circumstances stipulated in the agreement, by means of notifying the depositor legal entity within seven days after the change. The change in the amount of interest shall take effect on the 31st calendar day after the legal entity - depositor has been notified in writing. In case the customer does not agree to the new condition, the Agreement is terminated, and the bank pays the deposit amount and accrued interest to the customer. |

|

The Bank is entitled to modify and supplement the tariffs for additional services provided by notifying the Customers in accordance with the contract, by posting a relevant message on its own website ( www.conversebank.am ), by posting announcements on the Bank's premises, by sending a notification by post, and by any other methods proposed by the Bank selected at the Customer's preference, which is considered a due notification of the Customer. |

|

In accordance with the RA Law on Combating Money Laundering and Terrorist Financing, on the basis of the Know Your Customer Principle, the Bank may require the Customer to provide additional documents or other information, as well as ask questions during verbal communication, for the purpose of conducting due diligence of the Customer. |

|

The Bank may collect additional information in accordance with the terms of an agreement with the US Government under the Foreign Account Tax Compliance Act (FATCA) to determine your eligibility for being a US taxpayer. |

|

The account and the client's rights to dispose of the cash on the account may be restricted by a court decision on the basis of an application submitted by the law enforcement bodies or tax authorities or other competent bodies in accordance with the procedure established by law. |

|

Withdrawal of funds from the account without the customer's instruction may be carried out by a court decision on the basis of an application submitted by the court enforcement authorities and the tax authorities. These are reflected in the customer's bank account statements, which are provided to the customer in the manner agreed between the Bank and the customer. |

List of required documents

|

For individuals (except for private entrepreneurs) |

|

An ID card Public Service Number (PSN) or reference to the absence of PSN (only for RA residents and/or citizens); is not needed if the customer discloses an ID card bearing the PSN For a resident legal entity, an organization that is not a legal entity / does not have the status of a legal entity (hereinafter referred to as a legal entity) Statute The Decision of the founder set by the RA legislation or minutes of the general meeting of the founders for the corresponding organizational-legal type of legal entities, if the information on the founder's (shareholders, participants) shares and other data is missing in the statute, moreover: · If the shareholders or participants are individuals, information on the number of shares, ID card information, registration address, telephone number (if available), · In case the shareholders or participants are legal entites, the statute of the organization, state registration certificate, in case of a joint stock company, a certificate on shareholders possessing more than 5% share from the Central Depository of Armenia, Taxpayer Identification Number - TIN, if it is not included in the state registration certificate, Provided that the client deals with activities subject to licensing defined by the RA Law on Licensing, the relevant license (if available), State registration certificate issued by the RA State Register of Legal Entities Agency, Taxpayer Identification Number - TIN (tax code), if it is not included in the state registration certificate of the legal entity Copies of the ID document (s) of the executive officers set by the statute. For non-resident legal entity Statute Founding documents in accordance with the legislation of the country (certificate of incumbency, certificate of incorporation, etc.) Information about shareholders, participants, if not mentioned in the statute, moreover: · If the shareholders or participants are individuals, information on the number of the shares, the details of the identity document, registration address, telephone number (if available) · If the shareholders or participants are legal entities, the statute of the organization, the state registration certificate, in case of a joint-stock company a certificate on the shareholders possessing more than 5% share, Taxpayer Identification Number - TIN, Provided that the client deals with activities subject to licensing defined by the RA Law on Licensing, the relevant license (if available), Certificate of state registration issued by the relevant authority of the given country, Copies of the ID document (s) of the executive officers set by the statute. For private entrepreneurs · State registration certificate issued by the RA State Register of Legal Entities Agency · Provided that the client deals with activities subject to licensing defined by the RA Law on Licensing, the relevant license (if available), · TIN (tax code), if it is not included in the state registration certificate · ID card · Public service number or a reference of not having PSN (required only from RA residents and / or citizens) is not required if the customer presents an Identification card bearing PSN.

In addition to the aforementioned documents, the Customer has to disclose the proofs of origin of the amount and/or a declaration on the origin of the financial resources if the deposited sum, as well as the total sum of the previous deposits and the currently deposited sum are in excess of AMD 5 million or equivalent in foreign currency. The aforementioned documents are not required from the Bank’s accountholder customers, whose legal files contain the relevant documents and proofs of the origin of the financial resources. If the submitted documents are not in Armenian, English or Russian, a notarized translation into the particular languages is required.

|

Your financial directory

"Your financial directory" at www.fininfo.am , is an electronic system combining services offered to individuals that makes it easy to search, compare and find the most effective option for you https://www.fininfo.am/compare-deposit:

Notice on the terms and conditions of the deposit refund guarantee

(Applicable to individuals and sole proprietors)

The deposit refund guarantee is provided by the Deposit Guarantee Fund (hereinafter referred to as the Fund).

|

The currency structure of the deposit |

Maximum amount of deposit guarantee |

|

|

If you have only an AMD-denominated deposit in the same bank |

16 million AMD |

|

|

If you have only a foreign currency-denominated deposit in the same bank |

7 million AMD |

|

|

If you have both AMD-denominated and foreign currency-denominated deposit in the same bank |

If the AMD-denominated deposit is more than 7 million AMD |

16 million AMD (only AMD deposit is guaranteed) |

|

If the AMD-denominated deposit is less than 7 million AMD |

7 million AMD ( AMD- denominated deposit is guaranteed in full, and the foreign currency-denominated deposit is guaranteed in the amount of difference between 7 million AMD and the difference between the amount of deposits subject to refund) |

|

Location of the foundation: c. Yerevan, Khorenatsi 15 ("Elite Plaza" business center)

Phone: 374 10 583514

Settlement of disputes

Any disputes and disagreements between the Customer and the Bank shall be resolved first by mutual negotiation, and should the agreement not be reached by such methods, the disputes and disagreements shall be resolved in accordance with the procedure prescribed by the RA legislation both per court procedure, and through financial system mediator.

Notice on Financial System Mediator

Please be informed that according to the RA Law on Financial System Mediator, in case of property claims arising out of services rendered to you by Converse Bank CJSC, disputes and disagreements for not exceeding million AMD or equivalent foreign currency may be resolved through the Financial System Mediator.

According to an agreement between the Bank and the Office of the Financial System Mediator, the Bank waives the right to challenge the Financial System Mediator's decisions only in relation to property claims not exceeding 250,000 (two hundred and fifty thousand) AMD or equivalent currency, and on transaction amounts not exceeding 500,000 (five hundred thousand) AMD or equivalent foreign currency.

Address: 0010 Yerevan, Khorenatsi str. 15,

"Elite Plaza" business center, 7th floor

Email: [email protected]

Telephone: (+37460) 70-11-11

Fax: (+37410) 58-24-21:

Contact with the Bank

For more details and more information you can:

- visit the Bank's website at https://www.conversebank.am

- visit the Bank's Customer Service at the Head Office or any branch

- Call: 374 10 511211

- WhatsApp: +374 95 511211

- Skype: conversebank-callcenter

Updated 14.01.2024