Deposit Orakan

Terms and Condition of Deposit

|

Currency |

AMD, USD, EUR |

|

Deposit type |

Time deposit with no option of adding |

|

Min deposit |

30.000AMD, 500USD, 500 EUR |

|

Maturity |

From 45 to 545 days |

|

Payment of interest |

At expiry |

Annual simple interest and percentage yield

The annual percentage yield is calculated based on the interest rates set by the Bank's "Progress" deposit by the following formula:

Where:

• Տ - the annual interest rate of the deposit “Orakan”,

• Ա - "Progress" deposit interest rate which is the closest to the invested deposit and has shorter time period,

• Բ - "Progress" deposit interest rate which is the closest to the invested deposit and has longer time period,

• Գ – difference between the days of "Progress" deposits closest to the invested deposit with shorter and longer time periods,

• Դ - difference between the days of the deposit and the nearest "Progress" deposits with the shortest maturity.

A contractual interest rate is established if the deposit amount exceeds AMD 50,000,000, USD 100,000 and EUR 50,000.

|

Attention |

|

Interest payable is subject to income tax at the rate of 10% |

|

For cash redemption of deposit opened non-cash, commission is charged at 0.25% for AMD / 3% for USD and EUR* |

|

* The Bank may set a more favorable commission fee for customers. |

|

Settlement/current account opening tariffs for depositors if deposit is opened at branch |

||

|

1 account in deposit currency |

Opening of an account |

AMD 0 |

|

Annual service/maintenance of an account |

AMD 0 |

|

|

Other terms: based on account opening and servicing rules of the Bank |

Calculation example

On below terms

|

Initial deposit |

100,000,000AMD |

|

Opening day |

1/07/2024 |

|

Maturit |

70 days (until 09/09/2024) |

|

Annual interest rate |

5.78% |

|

Payment of interests |

At expiry |

|

Income tax |

10% from interest income |

Daily interest income during a leap year

1,000,000 (deposited sum) x 5.78/100 (annual interest rate) / 366 (number of days in a year) = 157.92

Total interest income for 70 days

157.92 x 70 days = 11,054.64

Net interest income for 70 days

11,054.61 - 1,105.46 (10% from total interest income is subject to income tax) = 9,949.18 (interest payable to the depositor at the end of the term of the deposit)

Total amount of deposit (initial amount + interests after taxation) AMD 1,009,949.18

Calculated amounts are rounded up to one hundredth.

Annual percentage yield

The interest against the funds on your account are calculated based on the nominal interest rate, and the annual interest yield shows the income you would earn if you redeposited the interests generated against the deposit.

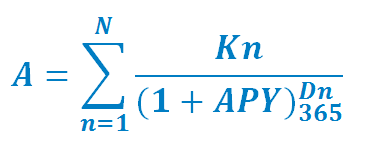

The annual percentage yield is calculated based on the following formula set under the CBA Regulation 8/02 “Calculation of Annual Percentage Yield of Bank Deposits”

where`

- A – initial amount of deposit

- ո - The successive cash flow number against the deposit

- N - the last cash flow against the deposit (including cash flow at the time of opening the deposit), after which the deposit agreement term is to be over,

- Kո - Flows of deposit and / or capitalized interests at the time of opening deposit or operating time period and the flows of mandatory payments, if any,

- Dո - the number that indicates how many days have passed from the date of opening the deposit to the successive n - cash flow made against the deposit inclusive (at the time of opening the deposit: D1 = 0)

General terms for opening of deposit

1. Time deposit agreement is concluded between the Bank and the Depositor.

2. The depositor can be more than one person according to the agreement, in that case the agreement is signed by all parties and the deposit is managed and used with the right of joint ownership.

3. If depositors are more than one person the Deposit and accrued interests are paid to all depositors proportionally, or to one of them on the basis of a notarized power of attorney signed by the other parties.

4. Any person can enter sums to the deposit account if the account details are available while withdrawals are made only by the client or by a person authorized by him.

5. The Depositor has the right to open the deposit in the name of a third party according to the legislation of RA and internal legal acts established by the Bank.

Calculation and payment of interests

1. The interests are calculated against the actual balance of the deposit from the day of opening of the deposit until the day preceding the day of its return to the depositor or withdrawal from the depositor’s account on other grounds.

2. The Bank calculates the interests at a simple interest rate, taking 365 days in a year or 366 days in a leap year as a divisor.

3. The interest amount is calculated on a daily basis against the account balance.

4. Where the time deposit is opened with a foreign currency, the interests are paid to the depositor in AMD at the respective buy rate set by the Bank at the date of payment for the respective currency or, at the depositor’s discretion, in the currency of the deposit.

5. The interests calculated against the deposit, unless the depositor has received in the period set in the deposit agreement, are paid by the Bank to the depositor on the latter’s demand.

6. Unless the depositor demands the redemption of the deposit and the payment of the calculated interest after expiry, the agreement is deemed renewed on the terms and conditions of time deposits applied by the Bank at that point, unless otherwise required in the customer’s deposit agreement or based on the customer’s written instruction.

Additional information

1. Time deposit accounts are opened and serviced free of charge.

2. The deposit account is closed once the deposit agreement expires.

3. No current banking transactions can be executed on the deposit account other than opening and redemption of the deposit.

4. The deposit is opened at branches from the settlement/current account with the currency of the deposit; in the absence thereof, the deposit is opened free of opening and service/maintenance charge.

5. The interests accrued on the deposit and the funds credited to the deposit account are paid to the depositor free of any commission.

6. The information about the deposit opened with the Bank is deemed bank secrecy and the Bank guarantees its confidentiality.

Early termination of deposit agreement

1. If the time deposit is returned on the depositor’s demand before expiry, based on the depositor’s application, the interests are recalculated and the recalculation is made at the demand deposit rate applied by the Bank (currently 0.1%).

2. When the depositor dissolves the foreign currency/FX/ time deposit agreement on the condition of directly concluding a time deposit agreement with AMD on similar terms, the interests are not recalculated.

Communication with the Bank

You can communicate with Converse Bank CJSC either by mail or by email, whichever you prefer. Electronic correspondence is the most convenient, it is 24/7 accessible, is free of any risk of loss of paper-based information and ensures confidentiality.

Tariffs for issuance of statements and references

|

Handover of statements1 at the Bank (VAT included) |

|

|

Individuals

|

- for up to 3-year period: AMD 1,000 |

|

Legal entities |

Once (regardless the periodicity)՝ AMD 0 If copied: |

|

References to be submitted to various institutions1 (VAT included) |

|

|

For deposits opened in 1 month2 |

5,000 AMD |

|

For deposits opened earlier |

3,000 AMD |

|

Based on online application in the Bank’s site |

3,000 AMD |

|

1 For the simultaneous issuance of a reference and a statement to the same customer, the charge is applied only to the reference if such charge is set. 2 In the presence of several accounts, the date of opening of the earliest account is considered, irrespective of being included in the reference. |

|

|

Copies of Documents, Transaction Grounds and Other Information (VAT included) |

|

|

For up to 1-month period |

1,800 AMD per document |

|

For up to 1-year period |

3,000 AMD per document |

|

For over 1-year period |

12,000 AMD per document |

|

Postal Delivery of Statement (VAT included) |

|

|

In Armenia and Artsakh |

0 |

|

International |

Delivery service provider’s rate in cases under the law and the agreement In other cases, Delivery service provider’s rate + AMD 1,500 |

|

Delivery of Statements by Registered Mail (VAT included) |

|

|

In Armenia and Artsakh |

3,000 |

|

International |

Delivery service provider’s rate + 3,000 |

|

ATTENTION |

|

The Bank cannot unilaterally decrease the interest rate set under the deposit agreement for the deposit, which the individual has opened on the condition to receive it back at the expiration of a specific period or upon the occurrence of circumstances set under the agreement. |

|

The Bank can revise and amend Tariffs and Rates for additional services by giving a notice to the customers in the manner set under the agreement: by posting a message on the Bank’s website (www.conversebank.am), by making the information available in the Bank’s premises, by post delivery and by other methods offered by the Bank and selected by the Customer, which shall be deemed the proper notification of the Customer. |

|

For the purpose of the Customer’s due diligence in compliance with the RA Law on Combating Money Laundering and Financing of Terrorism, the Bank can demand additional documents or other information from the consumer and as well ask additional questions to the customer on “Know your customer” principle. |

|

Based on the Foreign Account Tax Compliance Act (FATCA) Agreement concluded with the USA, the Bank can collect additional information to clear out your status of a US taxpayer. |

|

The Customer’s rights to dispose the account and the cash on the latter can be restricted by the court decision based on the claims filed by the Enforcement Service or tax authorities or any other competent authority specified in the law. |

|

The funds can be confiscated from the account without the Customer’s instruction by the court decision based on the claims filed by the Enforcement Service or tax authorities. They are reflected in the customer’s bank account statements, which the Bank issues to the Customer in the manner agreed between the Bank and the Customer. |

List of Required Documents

For individuals (except for private entrepreneurs):

- An ID card

- Public Service Number (PSN) or reference to the absence of PSN (only for RA residents and/or citizens); is not needed if the customer discloses an ID card bearing the PSN

For a resident legal entity, an organization that is not a legal entity / does not have the status of a legal entity (hereinafter referred to as a legal entity)

Statute:

The Decision of the founder set by the RA legislation or minutes of the general meeting of the founders for the corresponding organizational-legal type of legal entities, if the information on the founder's (shareholders, participants) shares and other data is missing in the statute, moreover:

- If the shareholders or participants are individuals, information on the number of shares, ID card information, registration address, telephone number (if available),

- In case the shareholders or participants are legal entities, the statute of the organization, state registration certificate, in case of a joint stock company, a certificate on shareholders possessing more than 5% share from the Central Depository of Armenia, VAT number, if it is not included in the state registration certificate,

Provided that the client deals with activities subject to licensing defined by the RA Law on Licensing, the relevant license (if available),

State registration certificate issued by the RA State Register of Legal Entities Agency,

Registration number of a taxpayer (VAT / tax code), if it is not included in the state registration certificate of the legal entity

Copies of the ID document (s) of the executive officers set by the statute.

For private entrepreneurs

- State registration certificate issued by the RA State Register of Legal Entities Agency

- Provided that the client deals with activities subject to licensing defined by the RA Law on Licensing, the relevant license (if available),

- VAT number (tax code), if it is not included in the state registration certificate

- ID card

- Public service number or a reference of not having PSN (required only from RA residents and / or citizens) is not required if the customer presents an identification card bearing PSN.

In addition to the aforementioned documents, the Customer has to disclose the proofs of origin of the amount and/or a declaration on the origin of the financial resources if the deposited sum, as well as the total sum of the previous deposits and the currently deposited sum are in excess of AMD 5 M or the equivalent FX.

The aforementioned documents are not required from the Bank’s accountholder customers, whose legal files contain the relevant documents and proofs of the origin of the financial resources.

Unless the documents are disclosed in Armenian, English or Russian, the apostille or notarized translation into the particular languages is needed.

Your Financial Adviser

“Your Financial Adviser” is an electronic system for search and comparison and selection of the most efficient option of services offered to individuals: https://www.fininfo.am/avand .

Notice on Guaranteed Deposit Terms and Conditions

(Applicable both for individual customers and sole proprietors)

The deposit refund guarantee is provided by the Deposit Guarantee Fund (hereinafter referred to as the Fund).

|

The currency structure of the deposit |

Maximum amount of deposit guarantee |

|

|

If you have only an AMD-denominated deposit in the same bank |

16 million AMD |

|

|

If you have only a foreign currency-denominated deposit in the same bank |

7 million AMD |

|

|

If you have both AMD-denominated and foreign currency-denominated deposit in the same bank |

If the AMD-denominated deposit is more than 7 million AMD |

16 million AMD (only AMD deposit is guaranteed) |

|

If the AMD-denominated deposit is less than 7 million AMD |

7 million AMD ( AMD- denominated deposit is guaranteed in full, and the foreign currency-denominated deposit is guaranteed in the amount of difference between 7 million AMD and the difference between the amount of deposits subject to refund) |

|

Location: 15 Khorenatsi, Yerevan (Elite Plaza business center)

Tel. +374 10 583514

Settlement of Disputes

Any dispute between the Customer and the Bank, unless settled through negotiations, is resolved in compliance with the RA laws both judicially and through the Financial System Mediator (for individuals).

Notice on Financial System Mediator

Please be advised that based on the RA Law on Financial System Mediator, the disputes relating to a property claim for up to AMD 10 M or equivalent FX amount arising with regard to the services rendered to you by Converse Bank CJSC can be settled through the Financial System Mediator.

Based on the agreement concluded between the Bank and the Financial System Mediator, the Bank abandons the right to dispute the resolutions of the Financial System Mediator only for property claims not surpassing AMD 250,000 (two hundred fifty thousand) or the equivalent FX, and the amount of the transaction not surpassing AMD 500,000 (five hundred thousand) or equivalent FX.

Location: 15 M. Khorenatsi, 0010 Yerevan

Floor 7, Elite Plaza business Center

Tel. (+ 37460) 70 11 11

Fax (+ 37410) 58 24 21

Email [email protected]

Contact the Bank

For additional information, please

- Visit the Bank’s website https://www.conversebank.am

- Visit the Customer Service Office at the Head Office or any branch of the Bank

- Call +374 10 511211

- WhatsApp +374 95 511211

- Skype: conversebank-callcenter

Updated on 08.06.2024